LEADING CREDIT RATING AGENCY SHARES FORECAST ON OCEAN CONTAINER RATES

Fitch Ratings Inc. is an American credit rating agency and is one of the “Big Three credit rating agencies”, the other two being Moody’s and Standard & Poor’s. It is one of the three nationally recognized statistical rating organizations designated by the U.S. Securities and Exchange Commission in 1975.

FITCH WIRE

Global Container Freight Rates to Moderate as Ship Orders Rise

Mon 19 Apr, 2021 – 7:27 AM ET

Fitch Ratings-London-19 April 2021: Global freight rates will remain high in the short term, but will moderate in the longer term once shipping supply-chain disruptions are cleared and more new ships are deployed, Fitch Ratings says. Global container shipping companies are benefiting from high freight rates, which will help strengthen their balance sheets and offset the impact from increased investments in new vessels on financial metrics.

Demand for container shipping is high due to the mismatch between increased pandemic-induced trade (such as sales of personal protective equipment, furniture for home offices and garden equipment) and operational disruptions to the shipping supply chain, such as container box shortages and port congestions.

When pandemic-related restrictions are lifted, we expect seaborne trade and associated freight rates to remain strong for a while. High shipping rates will be supported by a quicker recovery in overall demand for goods compared to the pace at which supply-chain disruptions disappear. Seaborne trade will take longer to adjust to a ‘new normal’ and will continue to face operational inefficiencies in the medium term. However, we view current spot shipping rates as unsustainable and expect them to fall once disruptions from port congestions and the container shortage are resolved.

The recent blockage in the Suez Canal aggravated the global container shipping market’s tightness, even though it was short-lived and the backlog of several hundred ships waiting to transit has been largely addressed. Freight rates remained unaffected as the blockage was not sufficiently severe and protracted for shippers to meaningfully consider alternative routes, such as around the Cape of Good Hope, which would have taken around 10 days longer and would have exacerbated vessel supply shortages and increased rates.

That said, the simultaneous arrival of delayed vessels will increase operational pressure on main European ports such as Felixstowe (the UK), Rotterdam (the Netherlands) and Barcelona (Spain).

We believe that the shipping rates rally has peaked, having roughly quadrupled yoy on the Asia-Europe route and doubled on the Asia-North America route. We anticipate unchanged spot rates in 2Q21 due to a strong economic recovery and expect them to only start to gradually normalise from 2H21. Still, 2021 full-year results of container shipping companies are likely to be strong as high spot rates will flow through to contracted rates, while most investments in new vessels will be due after 2021.

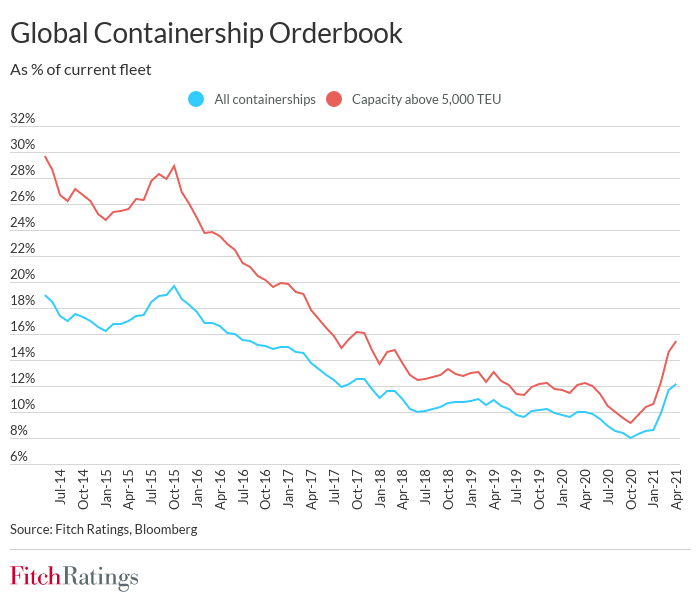

Our view of the long-term unsustainability of current rate levels is further supported by a rapidly growing containership orderbook, especially for larger vessels, i.e. 5,000 20-foot equivalent unit (TEU) capacity and above. Additional global shipping capacity will restore the market’s supply and demand balance. However, there is a lag of two to three years between the placement of vessel orders (which typically happens when freight rates are high) and delivery.

New ship orders have been spurred by favourable conditions in the global shipping market, low prices for new larger vessels and the availability of financing. The orderbook has grown and now represents 12% of the existing fleet, up from about 9% at the beginning of 2021. However, this is unlikely to lead to significant overcapacity similar to that of the 2008-2009 market crash, which began only a year after the containership orderbook represented about 60% of the global fleet. Shippers have deferred placing orders in recent years due to low freight rates and new IMO emission requirements, which left ship owners uncertain about their preferred options for compliance.